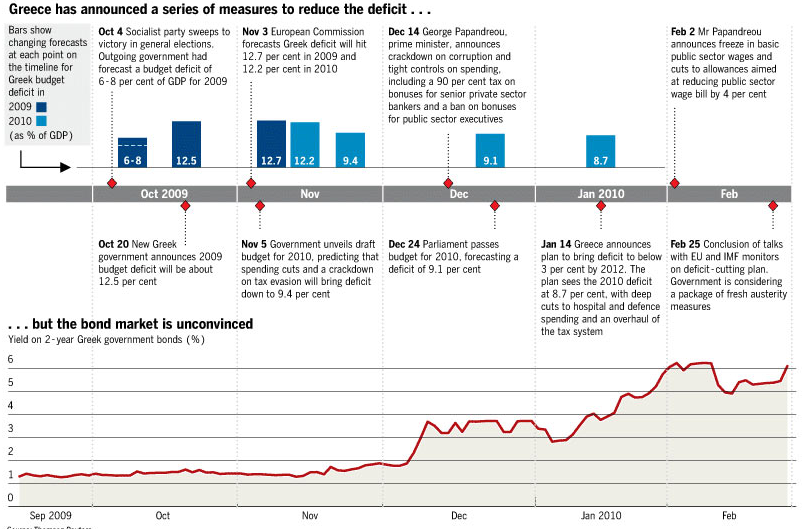

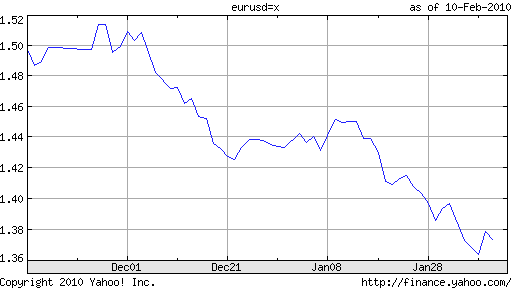

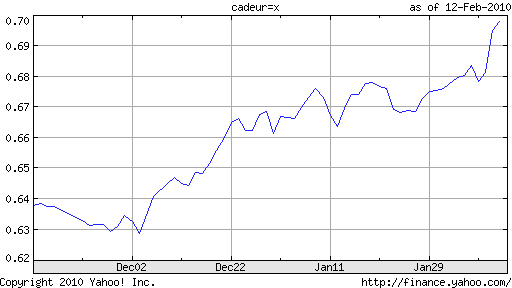

Fear’ loves the dollar. Conspiracy theories are rampant in Europe. It’s like watching a soap opera, a bad one, where you know what the next line is going to be. One plot has Greece blackmailing neighbors for monies via the EUR value, in another sub-plot Merkel believes speculators are taking a run at the currency, of course nothing to do with German fundamentals. We have Greek Union’s staging their second strike and Fitch Ratings downgrading four of its top Banks. For a screenplay, the material would be priceless! Bernanke delivers his semi-annual report on the economy to Congress today and tomorrow. His remarks come a week after the Fed decided to raise the ‘discount rate’ charged to banks for direct loans for the first time in 3-years. He will keep interest rates ‘low’ for an extended period…..again supporting growth currencies.

The US$ is weaker in the O/N trading session. Currently it is lower against 13 of the 16 most actively traded currencies in a ‘whippy’ trading range.

Global fundamental data got the ball rolling yesterday. First it was Europe and a weaker business confidence print, secondly, the US Dec. Case-Shiller Composite-20 Home Price Index fell -3.1%, y/y. On the plus side, the Home Price decline matched analyst’s median projections. That was probably the high point of yesterday’s session. It should be noted that the index has been improving over the last 18-months. Digging deeper, the seasonally adjusted index rose +0.3%, m/m, in Dec. and marks the seventh consecutive monthly increase. Analysts believe that rising home sales, driven by the strengthening economic activity and tax credits, should, for the time being at least, continue to support sale prices in the coming months. Fourteen of the twenty regions managed to post month-over-month home price gains. That matches the Nov. headline print.

The market hung their hat on yesterday’s US consumer confidence numbers. The index plummeted to a 27-year low (46 vs. 56.5), a low that’s expected to be temporary. Yesterday’s print bought confidence levels back to last years spring levels. Digging deeper, while both the present and expectations components declined during the month, it was the former that fell to a 27-year low, as consumers became less optimistic about ‘the’ economic recovery and specifically the labor market. Despite all of yesterday’s negativity prints, analysts believe the markets will experience some sort of reversal next month after the last few weeks unexpected strength announcements by many of the economic indicators. Are they taking the weather variables into account? Confidence in the labor market declined last month after improving in Jan. as individuals believing that jobs were ‘plentiful’ fell to 3.6%, while those saying that jobs were ‘hard to get’ rose to 47.7% from 46.5%, thus widening the spread between the two indicators. Expectations for business conditions, employment and income over the next six-months also deteriorated. The number of consumers expecting worse conditions, fewer jobs and a decrease in income also managed to advance during the month. On the bright side, the number expecting to purchase a home advanced to +2.7% from +2.4%. Analysts believe various temporary factors are dragging this component higher, such as low borrowing costs and the looming expiry of the first-time homebuyers’ incentive program.

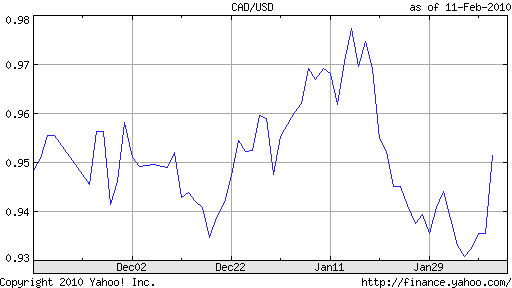

The USD$ is currently is lower against the EUR +0.18%, GBP +0.16%, CHF +0.16% and JPY +0.04%. The commodity currencies are mixed this morning, CAD +0.07% and AUD -0.22%. Growth sensitive currencies are always going to fare the worst when capital markets believe that growth will stall. The loonie has had a one way ride over the last two trading session. The currency has managed to retreat from its 4-month high as European and US consumer confidence surprisingly fell this month, which is directly effecting global equity and commodity prices. The CAD has traded in a well defined 5c’ish trading range this month 1.03-1.08, occasionally finding alternative support from Cbanks reserve requirements. Technically, without their presence the loonie would have probably fared much worse. Despite this, with sustainable global growth questionable, and risk aversion trading strategies being implemented, the currency will be expected to give back more of its recent market premium. Tomorrow is ‘oil day’ and the monthly seasonal’s may provide a temporary cap for the USD if business needs to be executed. Technically, just under the 4-month highs we witnessed earlier in the week, remains strong demand from long term hedgers and corporate Canada, however, on the top side there is very little interest from these types until we approach 1.8000 again. Governor Carney has pledged to keep O/N lending rates at a record low (+0.25%) through June this year, unless the country’s inflation outlook shifts. Year-to-date, it is the fourth best currency vs. its southern neighbor. On a cross related basis it has outperformed most of its major trading partners. Whether it’s an increased risk appetite or acting as a surety currency, the loonie by default has remained well sought after this year. Now, we are back to following the leader, and that’s the dollar, for major currencies directional play.

The AUD continues to trade within striking distance of its decade high vs. the EUR on speculation that Greece’s fiscal deficit is set to widen. Again, there is optimism this morning that the country will retain their yield premium as US policy makers dampen speculation that they will be raising interest rates any time soon. Earlier last week, the AUD rallied to its strongest monthly print after the RBA said that further ‘increases to the benchmark interest rate are likely if the economy improves’ (3.75%). Futures traders continue to bet that the RBA will hike rates early next month. It’s difficult to bet against the currency. According to the RBA, ‘the economic situation is stronger than expected and it is natural for monetary tightening’ to take place currency. The currency declines have been tempered by Governor Stevens’ remarks that the Australia’s benchmark rate was below normal. He said borrowing costs for ‘businesses and households were still about 50 and 100 basis points below average’. The rhetoric looks like its giving the green light to Capital Markets to expect another hike. So far, the futures market is pricing in a 44% chance of one at the Mar. meeting. On pull backs, expect better buying of the currency (0.8900).

Crude is lower in the O/N session ($78.34 down -52c). The price of crude took it on the chin yesterday. Unable to breach the $80 resistance level, weaker European and US consumer confidence data managed to pressurize global bourses and give the risk aversion dollar a boost. At one point we witnessed the black-stuff pulling back $2-a barrel. It ended the day retreating just over 2% from its 5-week highs. The trend remains in tact this morning. The German confidence print has once again ignited the sovereign debt fears that have dominated the EUR’s value this trading year. Risk aversion trading strategies and employment fears will again price out the speculative element in all asset classes. This morning’s weekly EIA inventory report is expected to reveal another build up in inventories. Last weeks data had supported prices. It showed that distillate stocks fell more than anticipated. Distillate stocks, diesel and heating oil, fell -2.94m vs. a market expectation of only -1.5m barrel drawdown. The gains were somewhat tempered by the crude print climbing +3.1m barrels, much more than the +1.8m barrels that had been expected. A build in gas stocks of +1.62m barrels was in line with market expectations. Refinery utilization rates grinded higher on the week, up +0.7% to +79.1% of capacity. For market direction, we are now depending on equities and investors ‘on’ again ‘off’ again risk appetite. With the dollar reigning supreme, commodities may find it difficult to maintain traction.

A rebounding dollar has curbed the demand for all commodities, and that includes our precious ‘yellow metal’ that most of the trading community seems to have owned at one point in time. It certainly was the lemming trade of the last Q. However, the big picture concerns about deepening EU deficits becoming contagious should continue to support the yellow metal on ‘much deeper’ pull backs. Yesterday’s trading session was about leakage. With the dollar climbing, and with its negative correlation relationship with commodities, ‘weak’ longs exited the market. Various think tanks believe that with the sovereign-debt problems coupled with Cbanks printing money, in the end, gold will be the only hard asset speculators will want. For now, despite weaker fundamental data, let’s believe the IMF is the ‘bull’ party spoiler. Late last week they indicated that they will shortly begin ‘on-market’ sales of 192 tonnes of gold ($1,092). Continue to watch the dollar for direction.

The Nikkei closed at 10,198 down -153. The DAX index in Europe was at 5,597 down -7; the FTSE (UK) currently is 5,321 down -4. The early call for the open of key US indices is lower. The US 10-year eased 9bp yesterday (3.70) and are little changed in the O/N session. Supply and fears of supply had dealers and investors cheapening up the US curve most of last week, pushing 10-year yields to a 6-week high. We can forget that now, especially after yesterday’s weak confidence numbers in Europe and the US. Treasuries climbed as the US consumer confidence headline print fell more than forecasted and on speculation that Greece’s fiscal crisis may spread to other nations. Even the IMF indicated that ‘ballooning public debt is likely to force several countries to default’. Despite the Treasury Department selling +$126b worth of notes and bonds this week, the $44b 2-year auction was well received. The bid-to-cover ratio was +3.33, compared with the average at the last 10 auctions of +3.03. Last month’s sale drew a bid-to-cover ratio of +3.13. Indirect bidders (foreign central banks) managed to purchase +53.6%. In Jan., they bought +43.1%. Direct bidders, on the other hand, purchased +8.2%, compared with +10.8% at the last sale. Today we get the $42b 5-years and tomorrow $32b 7-years. Even if the economy shows signs of strengthening, its unemployment, by remaining high, continues to have a negative effect on consumer confidence. Dealers will tell you that 2-year product continues to look rich on the curve and are likely to remain that way as long as the Fed’s ‘extended period’ language persists.