By now, most investors are well aware of the acronym BRIC, which stands for the emerging market powerhouses of Brazil / Russia / India / China. When the idea was conceived in 2003, it seemed to make a lot of sense, as these four economies were at the top of the GDP ‘league tables,’ year-after-year. While China, India, and to a lesser-extent, Brazil, all continue to outperform, Russia has begun to lag. Perhaps Russia needs to be replaced as a member of BRIC. If the acronym is to be preserved, the only choices are Romania or Rwanda.

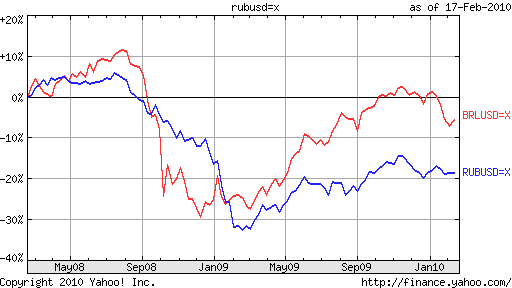

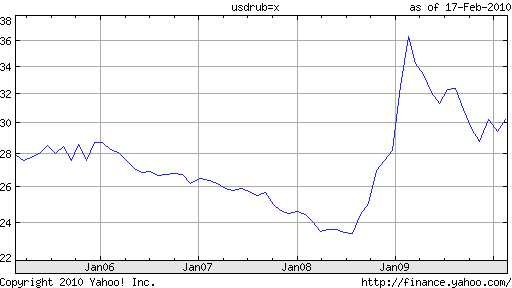

But seriously, last year Russia’s economy declined by 8%, compared to expansions of 6.5% and 8.3% in India and China, respectively. The Ruble fared equally poorly, relatively speaking. Compared to the Brazilian Real, which erased most of its 2008 decline, the Ruble’s rise offset less than half its previous losses. A similar picture can be painted with its. stock market. Not coincidentally, oil/gas prices have followed a similar pattern.

That the fortunes of Russia’s economy are too closely tied to energy exports is only half of the problem. The other half is as much cultural as structural. Russia’s economy is still largely oligarchical, and competition is lacking. Corruption is rampant, and the bureaucracy is out of control. In short, there is “a combination of corruption, poor governance, government interference in the private sector, and insufficient investment in the oil and gas sector,” which makes it unlikely that the Russian economy will embark on a stable course of development anytime soon. “What’s more, the warning signs of more economic trouble ahead are growing — for example, the increasing rate of non-performing loans on Russian banks’ balance sheets.” To put it bluntly, Russia’s economic prospects are somewhere between bleak and pathetic.

What about the Ruble, then? In the long-term, the Central Bank has pledged to shift its monetary policy away from micromanaging the Ruble. For the time being however, it remains focused on keeping the Ruble within a carefully prescribed range. Of course, it’s unclear whether the Central Bank sees its charge as defending the Ruble against a decline or against excessive depreciation, so currency traders shouldn’t read too much into it.

On the surface, the Ruble would seem to represent an excellent candidate for the carry trade. Despite being trimmed 10 times in 2009 alone, the Central Bank’s benchmark interest rate still stands at a healthy 8.75%. Moreover, the Central Bank has basically promised not to cut rates any further from the current record low. Remarkably, though, real interest rates are slightly negative, as Russia’s estimated inflation rate is 8.8%. Even more remarkably, this is the lowest level in decades! In other words, there is no interest too be earned from a Ruble carry trade, and the only upside is the appreciation in the Ruble.

And that ignores the downside risks, which are significant. After Russia defaulted on its debt in 1998, the international financial community basically lost confidence in the Ruble. Now, all of Russia’s government debt is denominated in foreign currency, mainly Dollars and Euros. Russian investors seem to harbor the same suspicions about their currency, and in 2008, the Ruble’s fall became self-fulfilling as investors transferred more than $150 Billion out of Russia, in the fourth quarter alone.

In short, I see very little upside from investing in the Ruble. There is no money to be earned from a Ruble carry trade. Betting on the Russian economy seems misguided. Betting on a continued rise in oil and gas prices would be better achieved by buying oil and gas futures directly. Meanwhile, any hiccup in the global economic recovery will certainly be met with an exodus of capital from Russia. Stick to the BIC countries instead.

No comments:

Post a Comment